We use cookies to enhance your website experience. By using this website, you agree to our use of cookies.

Lendermarket score

To help our investors community to make informed investing decisions, we monitor and score our Loan Originators. Loan Originators are scored in four categories; Transparency, Legal, Financial and Transactions.

How Lendermarket score works?

The Loan Originator is assessed in four categories; Transparency, Legal, Financial and Transactions.

Transparency is monitored by how much public information is available on the Loan Originator’s website or other public domains. This includes financial information, presentation of management/ownership, and screening for adverse media. In the Legal category three aspects are monitored; assessment of its supervising body, anti-money laundering policies and reporting obligations, and compliance with the Rules of the Platform. Financial monitoring includes tests related to the quality of underwriting policy (e.g., Loan Originator’s portfolio quality), meeting of financial covenants agreed with Lendermarket (e.g., interest coverage ratio), and audit of financial statements (e.g., points are awarded if a recognised auditor is used or if financial audit is voluntarily made etc). For the Transaction category a sample is selected representing Loan Originator’s agreements with investors and checks are carried out related to underlying loan agreement, disbursements to and repayments from the underlying borrower.

Subscores

Subscores help investors to evaluate different aspects related to the risk of loans available for investment. They are expressed numerically and are assigned to these 4 categories: Transparency, Legal, Financial and Transactions. Subscores contribute to the Risk Score with the following weight: 10% Transparency, 20% Legal, 30% Financial, 40% Transactions. A total of 100 points may be awarded to a Loan Originator, which translates to the Risk Score of 10. The higher the numerical value, the less risk has been detected by Lendermarket’s monitoring team as more tests were passed by the Loan Originator. Not all tests are equally the same for all Loan Originators (e.g., financial covenant levels may vary depending on the Loan Originator).

Transparency

Public access to financial information: Availability of Financial information to the public; A duly signed and full version of Financial Statements accessible by public.

Public access to other non-financial information: Corporate information and contact details available; Management information is available; Ownership information is available and have been fully verified; Adverse media screening.

Legal

Supervision: Determination of the supervising authority (financial supervisory authority, consumer protection board, or financial intelligence unit); Validity of the registration and / or authorisation; Findings from the Supervisory inspection.

Management of money-laundering risk: Applicability of anti-money laundering laws; Appointment and registration of MLRO.

Management performance: Criminal Records of Management; Frequent changes in Management; Detection of breaches with the Rules of the Platform.

Financial

Underwriting quality: Level of portfolio in arrears; Portfolio repurchase rate; Rate of extensions.

Financial covenants: Adjusted equity ratio; Interest coverage ratio; Non-performing loans ratio; Debt to equity ratio.

Financial Statements: Mandatory or voluntary audit; Recognition of auditor; Auditor’s opinion.

Transactions

Underlying agreement: Enforceability test; Check of counterparty; Check of term.

Disbursement to underlying borrower: Loan payment date matching; Quality of proof.

Repayments from underlying borrower: Loan repayment dates matching; Quality of proof.

Lendermarket score

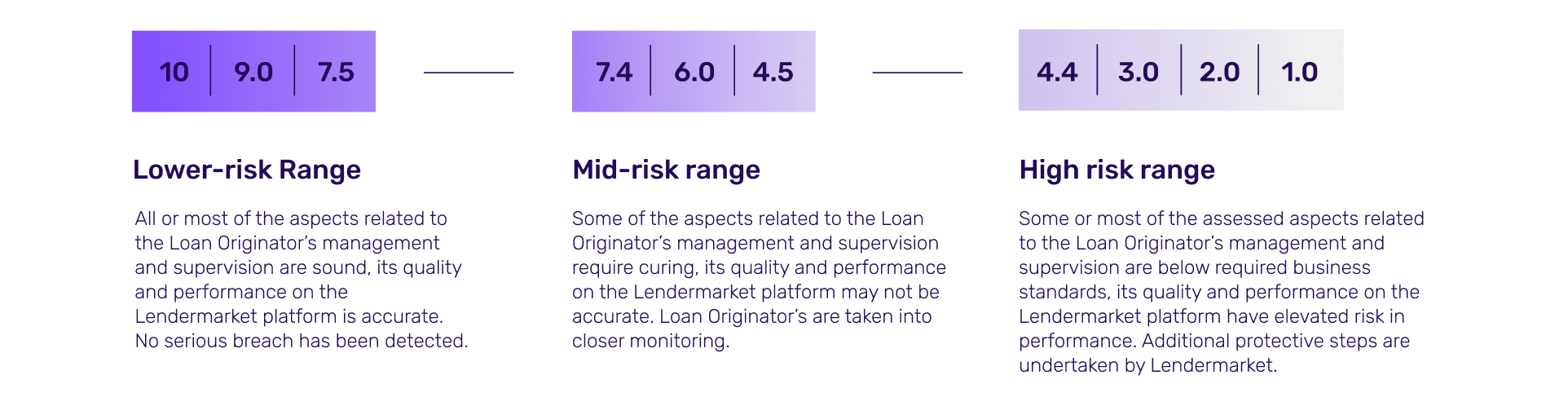

Lendermarket score illustrates the risk level related to each Loan Originator on a scale from 1 to 10, when 1 is a high risk, and 10 – is a low risk.

How often is the score updated?

We have designed our monitoring procedures so that the testing exercises are mostly quarterly. However, we may update the score more frequently as certain covenants are monitored on a weekly or monthly basis (on a rolling basis).

Under no circumstances should the Lendermarket Score be treated and relied upon as a credit rating in accordance with the methodology and provisions defined by the Regulation (EC) No. 1060/2009 on credit rating agencies. Lendermarket’s Score is not investment advice and Lendermarket cannot be held liable for any losses which may result from basing investment decisions on information and/or analytical materials provided on this website.